The vast majority of people share the project equally, avoiding the discomfort of discussing unequal division. However, it’s a time bomb and that’s why. Imagine that you and your partner shared the 50/50 project, then after some time something from the next…

How to divide shares in a startup between founders? What is the share of the early investor (when there are still a lot of risks)? How do you calculate the share of key employees?

It’s time to make a manifesto of Venture Concepts and here is its paragraph number 1:

“You don’t get what you deserve in life, but what you’ve agreed to.”

“How to agree” will be the main mantra in the course of this article

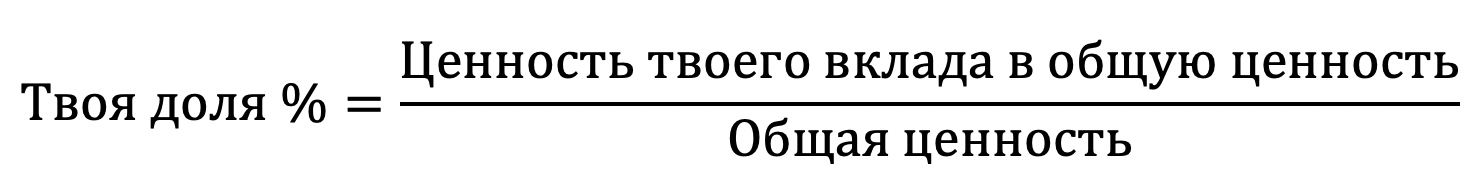

The ideal formula:

Your share of % (Value of your contribution to total value) / Total value

The vast majority of people share the project equally, avoiding the discomfort of discussing unequal division. However, it’s a time bomb and that’s why.

Imagine that you and your partner shared the 50/50 project, then after some time something of the following will happen:

- as a result, the office is essentially dragging you alone

- you will leave the project

- your cofaunder will leave the project

- you will bring another cofounder (including to replace yourself)

- a million other things

In the end, here’s what happens:

Your % > (Value of your contribution to total value) / Total value

Your % < (Value of your contribution to total value) / Total value

It turns out, not according to Venture Concepts, and therefore not honestly, although on the other hand, in life you get not what you deserve, but what you managed to agree on.

Then begins a framework that will help you agree in such a way that your agreement will asymptomtoically seek to feel “honest division” or, in other words, “by Venture Concepts.”

Venture community

Startups are made to find a repeatable and scalable business model. The key feature here is that the search may fail. That’s the biggest risk. Here are the key criteria for understanding how to share shares in a startup we need:

- to be honest

- reward for contributing to the common cause

- motivation to continue to invest effort and resources in the common cause

- takes into account how to behave when a person joins or leaves a team

- flexibility in the face of dynamic changes in the startup

- obstacle to the casual “and fish to eat, and sit down”

Thus, we should have a framework in which:

- if you make a 50% contribution to the common cause, you will get 50% of the company

- if you make a 30% contribution to the common cause, you will get 30% of the company

- if you make a 19.3% contribution to the common cause, you will receive 19.3% of the company

No more, no less.

“By Venture Concepts” is fun.

It is possible to agree in different ways on the optimal configuration in the company (most often for a glass of coffee or a kettle of vodka), but here we will consider a mathematicalized approach to the issue (not the fact that after reading this post you will count with your partners your shares on these formulas, but the general principle and course of thought you will have a more conscious and systemic).

Let’s translate into the language of numbers the entire contribution of the value of each start-up to the value of the common cause. Let’s call the value of the case dorm “Venture Dorm.” We will come to the theoretical value of your contribution and the theoretical size of the dorm, in such a way that:

Your share % – Theoretical value of your contribution / Theoretical value of the dorm

It is very important to understand that only “risky contributions” should be taken into account, such as:

- if you have invested in advertising (let you go into the common cause, not in debt) – then it is a risky contribution

- if you gave money to a startup (even your own) in debt (in credit), then not a risky contribution to the community, but just a loan (but if you “forgive” your loan as a contribution to the share capital, and the loan is only a scheme of money contribution, which you immediately agree – it can be considered a risky contribution)

- if you work for a startup as an employee, while earning a salary well below the market average, the difference between the average market salary and your reduced – risky contribution that you make to the Venture Community

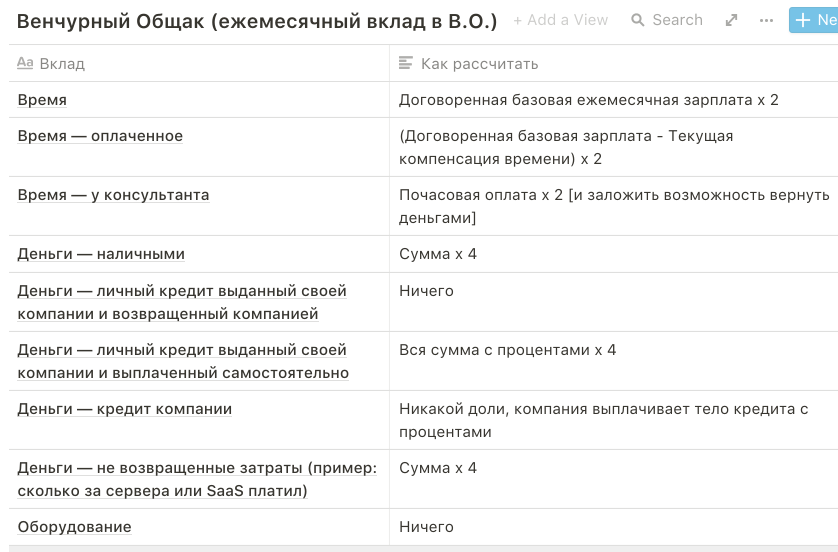

What can I contribute to the dorm?

- The money

- It’s time

- Brains

- Car

- Office

- unreturned costs

Convenience for the sake of made a crib.

About odds – why such values 2 and 4?

- First, you are free in your company to set values at your own discretion

- second, investments should multiply, so

- time multiplied x2 (to get Xs from the invested effort)

- money is multiplied by x4, for money is above time always

- what odds you have not chosen for yourself, the money should be higher than the time

- money has the highest ratio because of the concept of “skin at stake”

- In the exclusive below you will be able to adjust your own odds

Example

Consider two start-ups Sasha and Oleg (SEE and STO). They agree from the first day to conduct their dorm:

- for the first 8 months they don’t pay their salaries

- they agree that their basic estimated salaries are 400 and 300 t.r. as they received in their previous jobs

- The CEO also spends the first 3 months of 60,000r on testing advertising channels

- up to the first salary, the contribution of the guys to the dorm is 180,000r in advertising from the CEO (x4), as well as their basic salaries x2

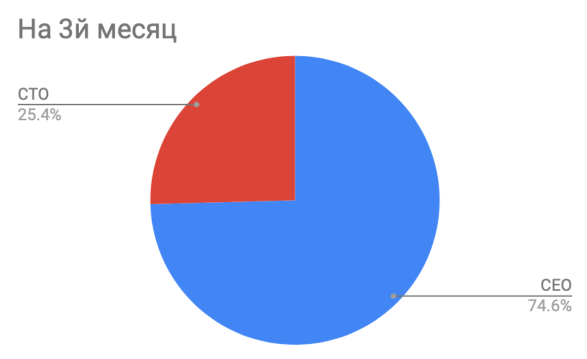

At this point, their shares look like this:

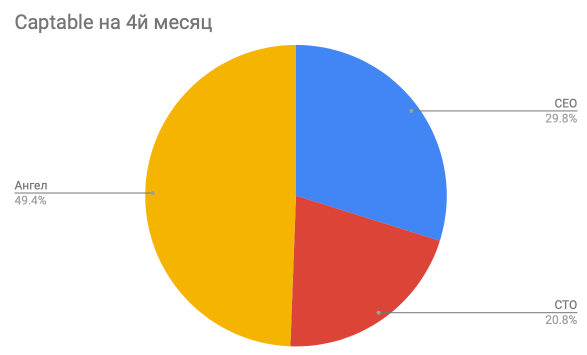

- for the 4th month they attract a friend pavel Nikolaevich as an angelic investor with the sum of 5 million. rub.

- the guys have the first signs that there is demand, but until the final product/market fit is still to work. They also decide to invest 1.5 million. Rub. personal savings (and do not want to be washed away much, given the entrance of the angel)

As a result, the shares are now:

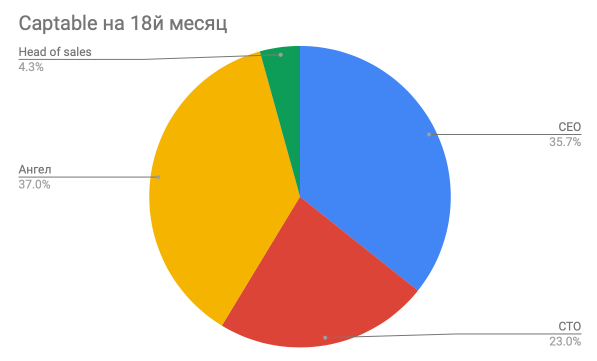

- at 9-10 a month their friend Ilya helped them with their first clients. Considering how exactly he keeps the ointment, offered to become his partner. Ilya’s salary was 320,000r, the guys can only pay him 280,000, which means Ilya has a risk contribution of 40,000r x 2.

- slowly the team works in the end of 1.5 years and runs to the round of venture investments.

At this point, the capitol is like this:

The case with this example can be studied here by making a copy and filling in your startup with their numbers.

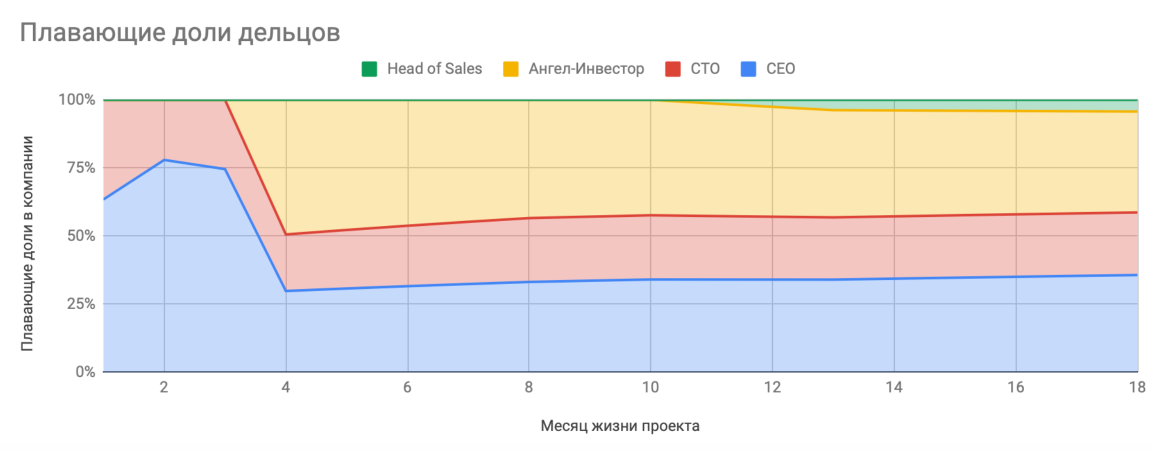

The evolution of the change in shares in the company below:

How long do I use the Venture Community principle?

Let’s think logically – when “risky deposits” will cease to be risky in a startup?

- When real income and stable Cash Flow appear

- When to attract Series A investment (freeze the state of the Dorm at the time of signing Termshit)

In other words, when you have the money to pay people market salaries (consultants – services at market prices).

Starting conditions

What if you started the project alone and then the partners joined you?

First, there is nothing to prevent you from starting to count the contribution as a loner (just you will temporarily be the only contributor to the W.O.).

Secondly, it should be taken into account that if you are something, and the sum of your skills, experience, authority and networking, relevant to the project, then it is already worth something and can be inventoryed in the t0-contribution dorm. Here’s an example:

- If your new startup is associated with monetization of advertising inventory, experience in advertising agencies, networks or similar companies – valuable

- If your new startup is related to the application of A.I., and you have developed a key machine-making algorithm for a startup, then this too can be inventoryed as a t0-contribution

Conclusions

- This framework at will can be used by start-ups in a full program (calculate captable purely mathematically)

- The agreed estimated market salary can be shared for everyone in a startup (to calculate the contribution by time), or individual for each (as agreed, but I would do individually). For example, you can use your salary in your previous job, from where you were not fired (and you yourself)

- you can use without a smque in mathematics, and using qualitative concepts about contribution, venture counter, good/bad leaver

- this same general approach can calculate not only the size of the founders’ shares, but also the size of options for key employees

- on the same framework it becomes more obvious why the strike price of the option for the employee who came later – higher than that of the employee working from the first days (more time worked – more X-earned)

- in theory, the amount of Venture Dorm may be a benchmark for evaluating your company “from the bottom” before the round, but this is a “case by case”

- those who came later, a priori receive less shares, because the rest already had a large temporary “fore” for the contraption in the Va., but there may be an exception if you have an additional. advantage for compensation – for example, if you brought the first big sales to the company as just helped the boys, then came to the company as Head of Sales, then you can add t0-contribution, measured in the 1st given sales (as agreed)

- money in business is the most valuable, even if you’re screwed, because the contribution of time can zero you, and the contribution of money will never be zeroed (if left with Venture Concepts)

- if you have a difficult situation in a startup, in which the investment is over, the investor is no longer willing to report, as well as your cofaunders, and you believe and decide to invest further, then also – invest money with a factor of x4, in theory can even agree to lower the valuation of the company (since such an ass), while do not forget about anti-dilution protection of investors (if there is)

Thanks to the source for the material: uklad.vc